Selecting a dental lab for OEM implant projects is not about outsourcing routine cases—it is about building a strategic partnership. True OEM readiness depends on engineering integration, certified quality systems, and structured workflows that guarantee repeatability, traceability, and long-term value.

For buyers launching new product lines, scaling implant production, or shifting from in-house manufacturing, the lab’s role goes far beyond unit cost. Critical evaluation points include control of digital assets, transparency of QA documentation, scalability under demand pressure, and the ability to support design iterations during pilot validation.

Key factors to examine include:

- OEM capability with early design involvement

- Engineering depth for full-arch, multi-unit, or guided workflows

- Collaboration models with structured approvals and responsive support

- Certifications and QA systems such as ISO 13485 or DAMAS

- Data and IP ownership covering CAD files, molds, and digital workflows

- Production scalability with reliable delivery systems

- Transparent pricing and ROI clarity

- Onboarding and validation steps before large-scale rollout

By focusing on these elements, decision-makers can identify OEM dental lab partners that deliver not only products, but also lasting technical success and commercial stability.

What defines a true OEM-capable dental lab for implant products?

A dental lab can only be considered OEM-capable when it goes beyond routine case production and builds a repeatable system for engineering, customization, and scale. The real difference lies in whether the lab can design, document, and reproduce implant products under controlled processes, rather than just fabricating restorations on demand. Buyers looking for OEM partners should focus on the technical depth and workflow maturity that separate these labs from standard service providers.

OEM-Dental-Lab-Implant-Capability

How is OEM production different from standard lab services?

OEM labs are structured to deliver repeatability and scalability. While a standard lab focuses on single cases, an OEM-capable lab develops controlled workflows:

- Documented protocols for each stage, from CAD design to QC approval.

- Engineering input to adjust margins, emergence profiles, or connection accuracy.

- Batch production capacity, ensuring the same product can be manufactured consistently at volume.

This difference makes OEM labs suitable for businesses that need stable long-term supply chains rather than one-off restorations.

What types of implant product customizations can OEM labs support?

OEM-capable labs are expected to handle advanced customization beyond aesthetic veneers or single-unit crowns. Typical implant OEM projects include:

- Customized Ti-Base and multi-unit abutments tailored to proprietary implant systems.

- Full-arch zirconia or hybrid solutions with validated digital workflows.

- Guided surgery kits or scan body compatibility to align with digital implant planning.

Such flexibility shows the lab can adapt to varied OEM buyers, from implant brands to distributors needing private-label systems.

Why is early engineering involvement important in OEM projects?

True OEM labs engage engineering support at the concept stage, not just in production. Early technical involvement ensures:

- Design for manufacturability – confirming components can be milled, sintered, or printed without compromising fit.

- Material compatibility checks – assessing whether zirconia, PMMA, or titanium alloys match the functional demand.

- Risk prevention – detecting tolerance issues before they scale into thousands of misfitting units.

For example, in one OEM partnership with a European distributor, early CAD alignment between scan bodies and custom Ti-Bases prevented recurring fit errors and saved months of downstream rework.

Embedding engineering early is the difference between a vendor and a true OEM collaborator.

In summary, a lab that can formalize processes, support deep customization, and bring engineering upstream is what defines OEM capability. For buyers, recognizing these elements means selecting a partner ready to grow with their product line, not just fulfill orders.

How to evaluate engineering and technical capabilities in OEM labs?

The engineering strength of an OEM dental lab is reflected in how well it integrates digital workflows, material science, and implant system compatibility into a repeatable process. A capable partner does not just “make parts,” but ensures each design can be scaled, validated, and adapted to complex implant cases. Buyers should look at material range, CAD/CAM integration, and the ability to support advanced workflows like guided surgery.

Dental-Lab-OEM-Engineering-Capability

What implant systems and materials (e.g. Ti-Base, zirconia) are supported?

Labs positioned as OEM partners should demonstrate broad compatibility with major implant platforms and advanced restorative materials.

- System coverage: Can they adapt to Straumann, Nobel Biocare, and regional implant systems with equal precision?

- Material range: Do they work seamlessly with zirconia, titanium, PMMA, or hybrid materials?

- Consistency in tolerance: Can they maintain micron-level fit across batches?

This ensures OEM buyers are not locked into narrow options and can scale product lines across multiple clinical markets.

Does the lab offer CAD/CAM integration and design for manufacturability?

Strong OEM labs integrate CAD/CAM platforms directly with engineering oversight. Evaluating them involves three steps:

- File compatibility – ensuring seamless import/export with 3Shape, Exocad, or Dental Wings.

- Design for manufacturability – checking that margins, angulations, and connection geometries are optimized for milling or printing.

- Validation loop – testing whether the digital design reproduces consistently in zirconia or titanium once manufactured.

Without these checks, even the best CAD designs may fail in production.

Can they support guided surgery solutions or full-arch custom workflows?

Beyond single-unit restorations, an OEM-capable lab should prove experience in complex workflows such as guided surgery or full-arch solutions. This means coordinating between digital implant planning, custom abutments, and surgical kits. In one case with a North American DSO, early validation of guide sleeve tolerances prevented mismatch during surgery and built long-term trust. OEM buyers benefit most when labs can bridge engineering design with surgical execution, not just lab-side production.

Selecting an OEM lab with these engineering and technical benchmarks ensures scalability and reliability. For buyers, it’s a signal that the partner is not only production-ready but also capable of supporting innovation pipelines in digital implantology.

What collaboration models and workflows define OEM partnerships?

OEM dental partnerships succeed when they operate like structured projects rather than transactional orders. The defining elements are clear approval checkpoints, consistent communication, and responsive technical support. A lab that formalizes these workflows can reduce errors, accelerate timelines, and provide buyers with confidence in long-term collaboration.

Dental-Lab-OEM-Collaboration-Workflow

How are design approvals, iterations, and milestones managed?

OEM projects require documented checkpoints that align both buyer and lab teams. Typical stages include initial CAD review, prototype validation, and final sign-off. Each milestone should be supported with digital files and QA records, ensuring traceability. Without this formalized approval loop, misalignments can easily escalate into delays or costly rework.

Is there a dedicated project contact or account support system?

Efficient OEM labs assign one central contact—often a project manager or account specialist—to coordinate between engineering, production, and logistics. This prevents communication gaps and makes troubleshooting faster. Buyers should confirm whether the lab offers:

- A single point of contact for project communication

- Defined escalation paths for urgent cases

- Regular update schedules (weekly calls, progress reports)

These mechanisms make a lab feel like an extension of the buyer’s own team.

How responsive is the lab in handling technical questions?

In OEM partnerships, technical questions arise frequently—ranging from abutment geometry to material testing reports. The difference between a vendor and a partner is measured by responsiveness. Labs with structured support often reply within 24 hours, provide annotated CAD feedback, and escalate unresolved issues to engineering quickly. For example, in one OEM program with an Asia-Pacific distributor, rapid clarification on zirconia sintering parameters avoided a shipment delay, reinforcing confidence in the collaboration.

Strong OEM workflows mean buyers don’t just receive products—they receive a process that reduces risk and builds trust. When collaboration is structured and communication transparent, OEM partnerships move beyond outsourcing and become long-term joint ventures.

What quality systems and certifications indicate OEM readiness?

An OEM-capable dental lab demonstrates readiness through formal quality systems and internationally recognized certifications. These are not optional add-ons but structural assurances that every implant component can be reproduced with the same precision, traceability, and safety standards. For buyers, certifications like ISO 13485 or DAMAS serve as clear signals that the lab can sustain consistent output at scale.

Dental-Lab-OEM-Quality-Certification

Does the lab meet ISO 13485, DAMAS, or ADA/NADL certification?

OEM buyers should first confirm whether the lab operates under globally recognized frameworks.

- ISO 13485: Medical device quality management system, ensuring regulatory compliance and risk control.

- DAMAS: Dental-specific quality system that standardizes documentation and auditing.

- ADA/NADL certifications: U.S.-recognized standards providing credibility in North American markets.

These certifications show that the lab is not only technically skilled but also formally accountable to international quality rules.

How are consistency and traceability managed in OEM-scale production?

Beyond certifications, a true OEM lab enforces consistency with batch-level control and product traceability. Every lot of abutments, Ti-Bases, or zirconia frameworks should be:

- Tagged with unique serial identifiers

- Recorded through production logs and QA checkpoints

- Traceable back to raw materials and digital files

In one OEM project with a European implant distributor, traceability records proved critical when a supplier batch of zirconia needed recall—the lab isolated affected units within 24 hours, minimizing disruption for the client’s downstream clinics. This level of control defines OEM maturity.

What documentation is provided (batch records, serial tracking, QA reports)?

A reliable OEM lab delivers documentation as part of the product, not as an afterthought. Buyers should expect:

- Batch records: confirming process steps and operator details

- Serial tracking: enabling recall or replacement when necessary

- QA reports: summarizing inspections, fit tests, or material verification

Such documentation makes the supply chain auditable and gives buyers assurance that production is controlled, not improvised.

Quality systems and certifications are the foundation of OEM partnerships. They convert trust into verifiable proof and give buyers confidence that scale will not compromise reliability.

How does the lab manage ownership of digital files, molds, and tooling?

In OEM partnerships, intellectual property and production assets often matter as much as the physical restorations themselves. A capable lab sets clear rules on who owns CAD files, molds, and tooling to avoid disputes later. Buyers should evaluate whether the lab provides transparent agreements that protect proprietary data and guarantee continuity, even if partnerships change.

Dental-Lab-OEM-Digital-File-Ownership

Who controls CAD designs, molds, and digital IP?

The starting point in any OEM evaluation is understanding asset control. Some labs retain ownership of CAD design files or proprietary molds, while others transfer them fully to the buyer. OEM buyers should confirm:

- Whether CAD files remain accessible beyond the lab’s internal servers

- If molds or tooling are transferrable without additional fees

- How intellectual property is licensed or transferred under contract

Without clarity, buyers risk dependency that may later complicate scaling or supplier diversification.

Are there agreements to protect proprietary data and workflows?

OEM-ready labs provide explicit agreements to protect confidential data. These often cover:

- Data encryption and storage protocols to safeguard files

- Non-disclosure agreements (NDAs) defining confidentiality terms

- Workflow ownership clauses that clarify what remains buyer-owned vs. lab-controlled

These agreements protect both sides and ensure that collaborative innovation, such as custom Ti-Base geometries or proprietary scan body designs, cannot be reused without consent.

What happens if the OEM buyer needs to switch suppliers?

Supplier changes are common in long-term manufacturing. The real test of OEM maturity is whether a lab can provide exit-friendly processes. This includes handing over CAD libraries, releasing molds, and providing full documentation for transition. In one OEM project with a U.S. distributor, a lab’s willingness to transfer validated CAD templates during a supplier switch avoided six months of redevelopment and kept implant kits on the market without disruption.

OEM partnerships are not only about production efficiency but also about protecting business continuity. Transparent ownership and clear transferability clauses signal that a lab is a true long-term partner rather than a dependency trap.

How transparent and scalable is the lab’s production and delivery system?

OEM buyers depend on their dental lab not just for precision but also for predictable, scalable supply. A transparent production and delivery system ensures buyers can monitor progress, anticipate timelines, and trust that the lab can handle demand spikes or disruptions. Scalability, combined with clear logistics tracking, is what separates a stable OEM partner from a short-term vendor.

Dental-Lab-OEM-Production-Delivery

Can the lab handle high-volume or seasonal orders reliably?

Scalability starts with capacity. OEM-ready labs demonstrate:

- Batch production systems that can scale from small pilots to thousands of units.

- Flexible staffing or shift scheduling to absorb seasonal demand spikes.

- Capacity planning tools to forecast and reserve production slots for large clients.

This ensures buyers are not caught in backlogs when market demand increases unexpectedly.

Is there a clear turnaround system and logistics tracking process?

Transparency means buyers can see where their orders stand. OEM labs often implement:

- Digital dashboards that show job status and estimated completion.

- Logistics tracking numbers tied directly to production batches.

- Predictable turnaround tiers (e.g., standard vs. rush) with documented lead times.

For instance, in one OEM collaboration with a Middle Eastern distributor, integrated logistics tracking allowed clinics to pre-schedule implant surgeries with confidence, reducing costly cancellations. Such visibility directly translates into customer trust.

How are production continuity and risk managed during supply disruptions?

Disruptions—whether from material shortages or global shipping delays—are inevitable. OEM-capable labs build resilience by:

- Dual sourcing materials like zirconia blanks and titanium rods.

- Maintaining safety stock of critical components.

- Documented contingency plans for re-routing production or shipments.

Labs that can communicate these measures upfront signal a higher level of professionalism. For buyers, this means smoother supply continuity even when external shocks occur.

Scalable production and transparent delivery systems are the backbone of a reliable OEM partnership. They provide the stability buyers need to plan confidently, even in volatile markets.

How should you assess pricing structures and long-term ROI in OEM projects?

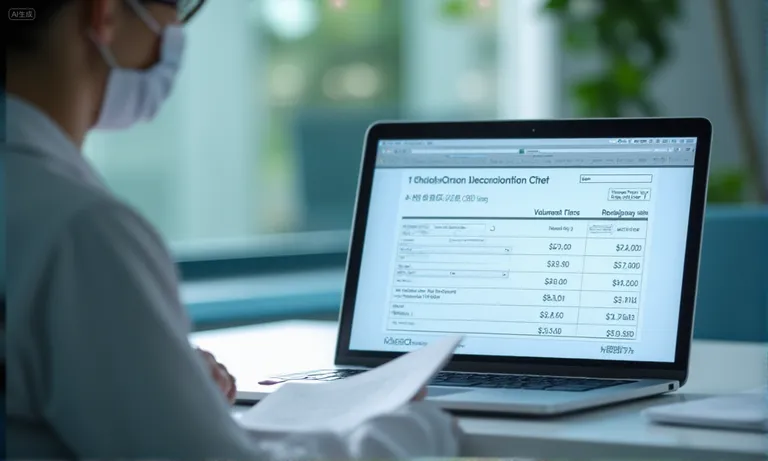

Evaluating the cost of an OEM dental implant partnership requires more than comparing quotes. The real assessment looks at how pricing models align with project scale, whether hidden costs are transparent, and how outsourcing impacts long-term ROI compared to in-house production. A lab that explains its pricing clearly and helps buyers project return demonstrates maturity and reliability.

Dental-Lab-OEM-Pricing-ROI

Is the pricing model volume-based, by complexity, or fixed-tiered?

OEM labs typically structure pricing in three ways:

- Volume-based: unit price decreases as order size increases, suitable for high-volume distributors.

- Complexity-based: price reflects design challenges (e.g., custom multi-unit abutments vs. single crowns).

- Fixed-tiered: standardized tiers that simplify forecasting for mixed case loads.

Buyers should confirm which model is applied and whether it matches their growth strategy.

What hidden costs should be expected (revisions, rush orders, remakes)?

Transparent OEM labs disclose potential add-ons upfront. Common hidden costs include:

- Revisions for design changes requested after approval.

- Rush orders that shorten standard turnaround times.

- Remakes if cases fail fit testing or need material adjustments.

Identifying these in advance prevents budget surprises and builds trust. For example, in one collaboration with a European DSO, pre-agreed remake policies reduced disputes and allowed both sides to focus on scaling rather than cost disputes.

How does outsourcing impact ROI compared to in-house manufacturing?

Outsourcing to an OEM lab often reduces capital investment in milling machines, scanners, and QA systems. The ROI comes from:

- Lower upfront equipment and staffing costs

- Faster speed-to-market for new implant products

- Reduced downtime, since the lab absorbs production risks

When calculated over several years, outsourcing often delivers higher ROI than in-house setups, especially for distributors or DSOs scaling across multiple markets.

Clear pricing models and transparent cost structures allow buyers to compare options fairly. When combined with ROI analysis, they turn financial planning from guesswork into strategic decision-making.

What onboarding and validation steps are critical before full production?

Before moving into full OEM production, buyers should require a structured onboarding and validation process. This ensures that technical accuracy, workflow compatibility, and communication routines are proven in a controlled environment. Skipping these steps often leads to costly misalignments once volume ramps up.

Dental-Lab-OEM-Onboarding-Validation

What should the pilot validation or case testing process include?

Pilot validation confirms whether the OEM workflow is production-ready. Key steps include:

- Prototype production – initial milling or printing of implant components.

- Fit and function testing – verifying abutment accuracy, screw seating, and occlusion.

- Material verification – checking zirconia translucency, titanium tolerance, or polymer strength.

- Clinical simulation – optional trial in non-patient models to ensure real-world usability.

These steps reveal weaknesses early, before full-scale rollout.

What technical benchmarks should OEM buyers test before launch?

Technical benchmarks provide measurable criteria for go/no-go decisions:

- Dimensional accuracy (micron-level tolerances across batches)

- Repeatability (same CAD design producing identical outcomes)

- Surface finish quality (critical for abutment-tissue interfaces)

- Digital file compatibility (3Shape, Exocad, or in-house platforms)

For example, in one OEM onboarding project with a European distributor, pre-launch tolerance checks across three pilot batches reduced later adjustment rates by more than 20%.

How long does it take to fully onboard and transition into production?

Timelines vary, but OEM onboarding usually unfolds in phases. The initial pilot stage may take 4–6 weeks, followed by incremental scaling as benchmarks are met. Transition to full production often takes 8–12 weeks, depending on complexity and order volume. Labs that provide clear Gantt charts or onboarding roadmaps help buyers plan inventory and market launches more confidently.

Onboarding and validation are not formalities—they are risk controls. For OEM buyers, demanding a structured pilot and benchmark-driven onboarding process is the best way to ensure a smooth transition into stable, long-term supply.

Conclusion

Choosing an OEM dental lab partner is about more than product pricing—it is about building a transparent, reliable, and scalable collaboration. A lab that combines engineering depth, certified quality systems, and structured workflows provides not just restorations but long-term value. By securing clear agreements on digital assets, validating production through pilots, and ensuring supply continuity, buyers reduce risk and maximize ROI. Partnering with an overseas dental lab that treats collaboration as a joint venture gives OEM buyers confidence to expand product lines and serve markets with stability and trust.